A Note from Karen

Living on the waters of Puget Sound for more than 20-years has been a privilege for me. Waking on the eastern shores of Bainbridge Island I have enjoyed many cups of coffee watching the sun rise. Beach combing, beach walking, crabbing, kayaking have been a great part of my island lifestyle.

A native Washingtonian, with 40+years of my life on Bainbridge Island has taught me how important our natural resources are. Bainbridge Is relatively a small island with 12-miles of shoreline, much has been developed and what has not is under strict management by the States’s Shoreline Management guides and the City of Bainbridge Island. Living on the water has been a privilege but I also feel like I am one of it’s guardians.

Bainbridge Real Estate Recap

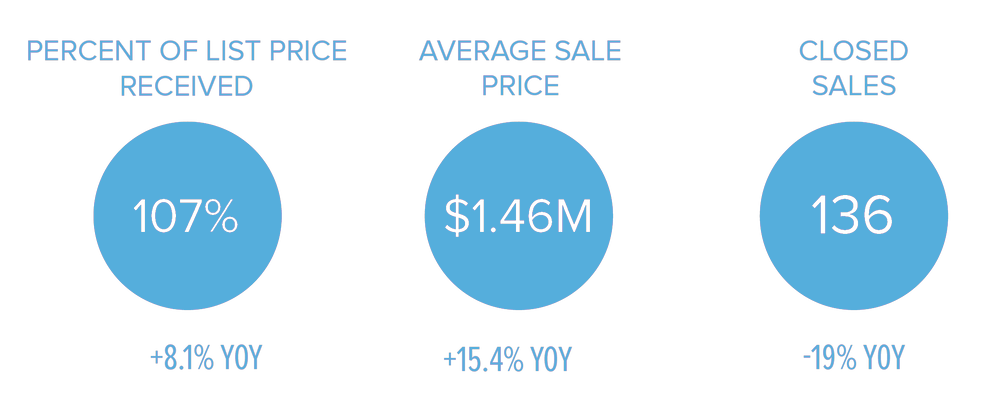

Bainbridge Island’s real estate market remains a strong seller’s market. In our third quarter, we continued to see homes sell above the asking price. We also saw a similar increase in average sale price when compared to this time last year. We’ve compiled key highlights to keep you in the know about our local market.